Welcome to ChinaCityPass! As you plan your exciting Chinese adventure, understanding how to manage payments is key to a smooth and enjoyable trip. China offers a dynamic and convenient array of payment options, from widely-used mobile applications to traditional methods like bank cards and cash. This guide will walk you through the most popular and accessible payment services, ensuring you can make transactions with ease throughout your stay.

Popular Payment Methods for Foreign Nationals in China

1. Mobile Payment Applications: Your Go-To Digital Wallets

Mobile payment services such as Alipay, Weixin Pay (WeChat Pay), and the UnionPay App are available for convenient payment services with just a mobile phone. These platforms typically allow you to pay by scanning a merchant’s QR code or by presenting your own QR code for the merchant to scan.

Alipay

Alipay has significantly optimized its services for foreign nationals to ensure a seamless payment experience.

• Multilingual Support: Alipay features a new multilingual translation service that supports 16 languages. These include Chinese, English, French, German, Spanish, Malay, Arabic, Italian, Portuguese, Russian, Turkish, Indonesian, Korean, Japanese, Thai, and Vietnamese. To use this, simply tap “Translation” on the app’s homepage and input text, audio, or a picture for translation. This service is also integrated into various in-app tasks like taxi-hailing, hotel bookings, ticket reservations, public transportation information, and checking currency exchange rates.

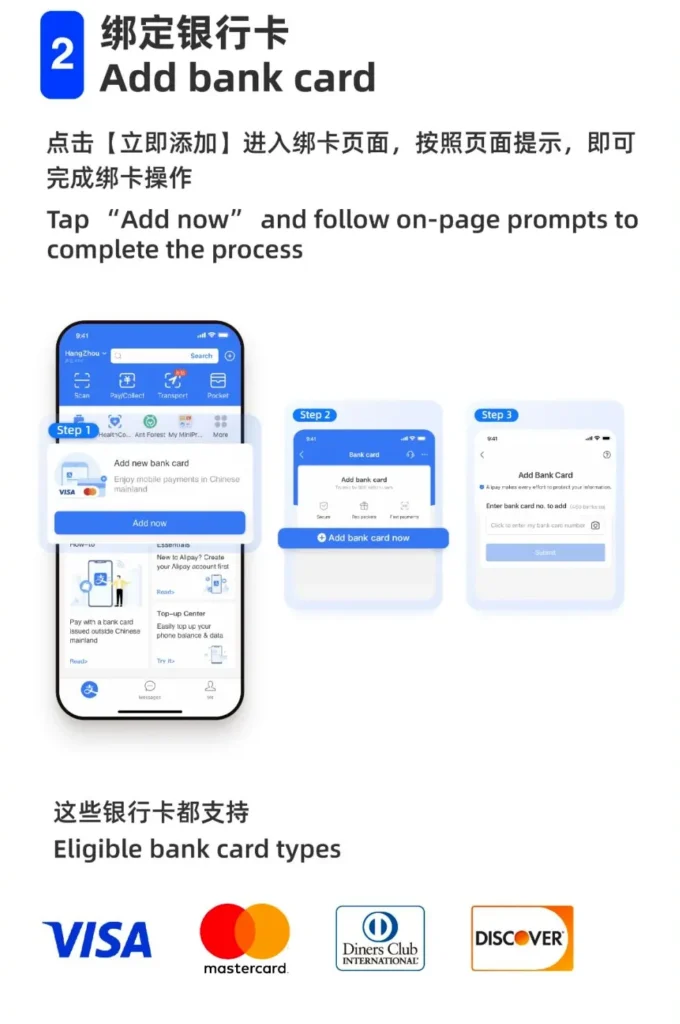

• Linking Overseas Cards: Alipay’s “Linking Overseas Cards in China” initiative allows overseas bank cards to be linked to the international version of the Alipay App. Once linked, these cards can be used for payments both within China and overseas. You can add Visa, Mastercard, JCB, Diners Club, and Discover cards to Alipay.

• Using Overseas Wallets: You can also directly utilize overseas wallets by scanning an Alipay QR code. Alipay currently supports users of 10 overseas wallets from countries like Malaysia, South Korea, and Singapore to complete payments by scanning a Chinese QR code.

• Increased Transaction Limits: Transaction limits for foreign nationals have been increased from USD 1,000 to USD 5,000 for a single transaction and from USD 10,000 to USD 50,000 annually.

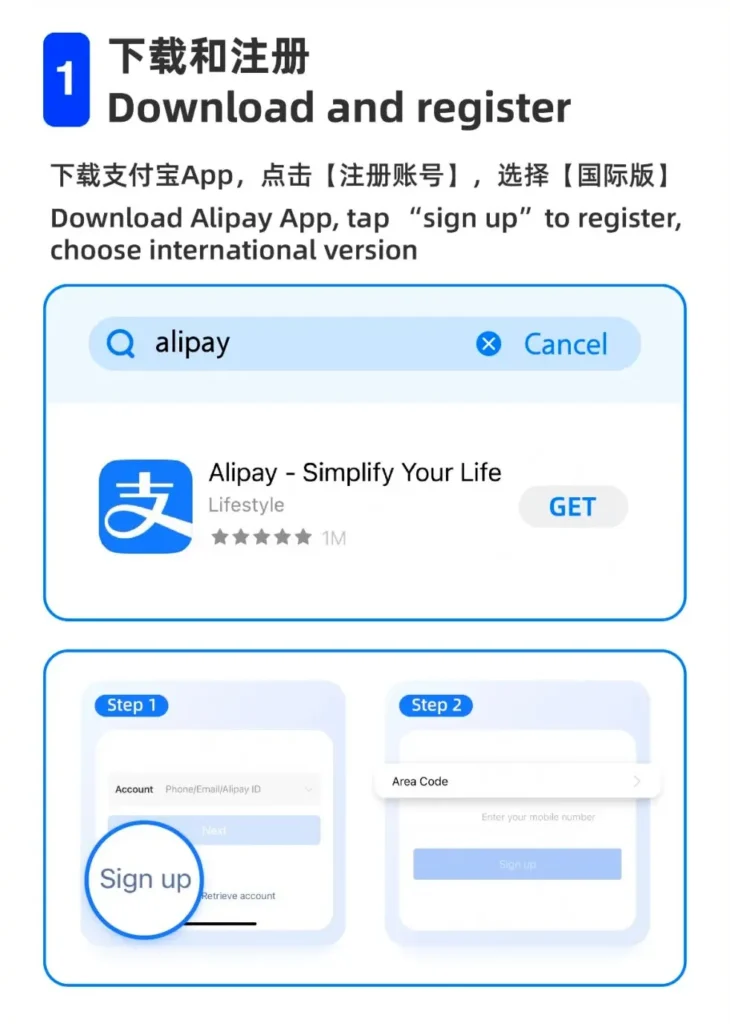

How to Use Alipay

2. Register/Sign In: Open the app and register with your phone number or sign in if you’ve already registered.

3. Add Bank Cards: Follow the on-screen instructions to add your eligible bank cards. Visa, Mastercard, JCB, Diners Club, and Discover cards can all be added to Alipay.

4. Pay: You can either tap “Scan” and scan the merchant’s QR code (Method 1) or tap “Pay/Receive” and present your QR code for the merchant to scan (Method 2).

• English Service Hotline: For assistance, you can call Alipay’s English Service Hotline at +86-571 2688 6000.

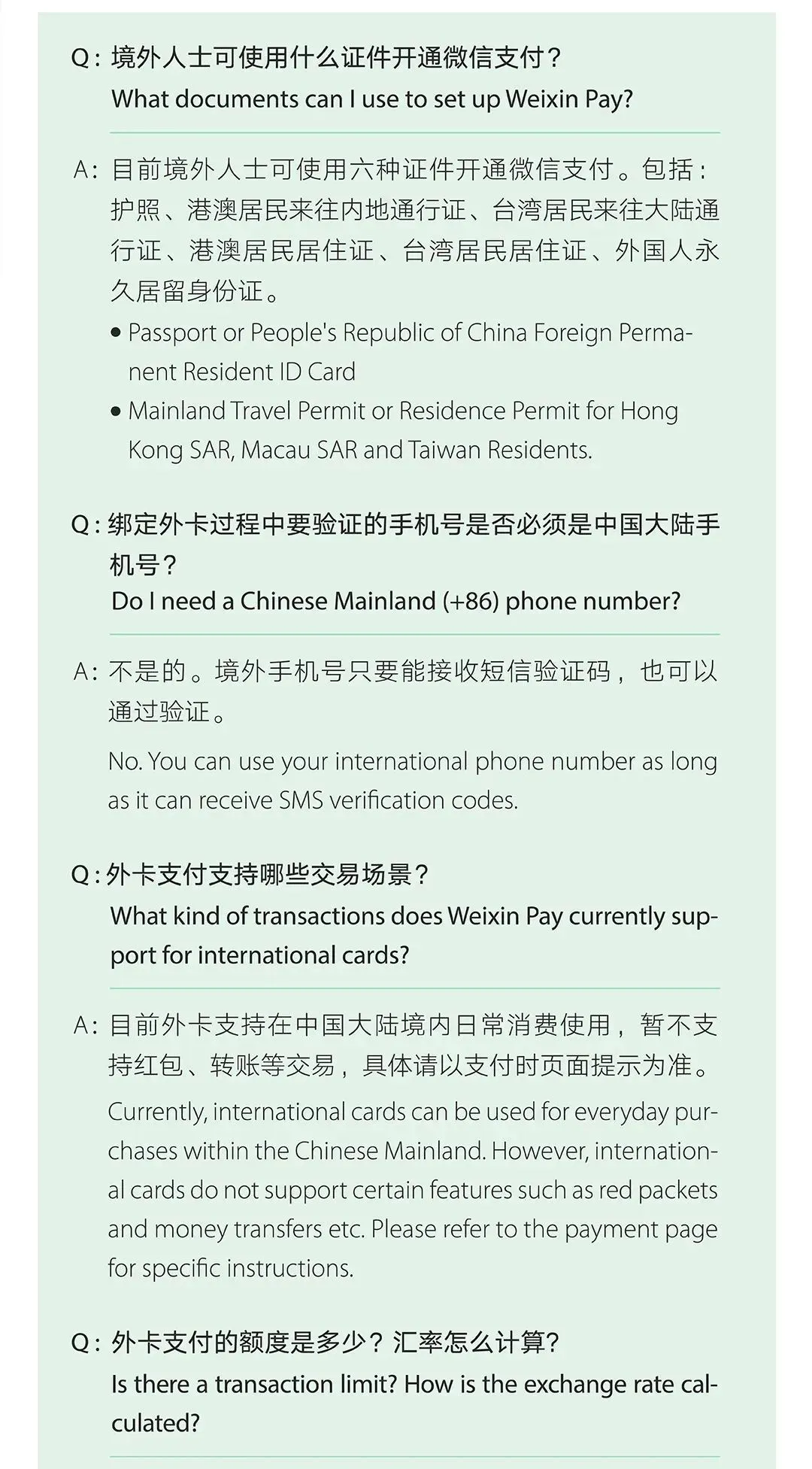

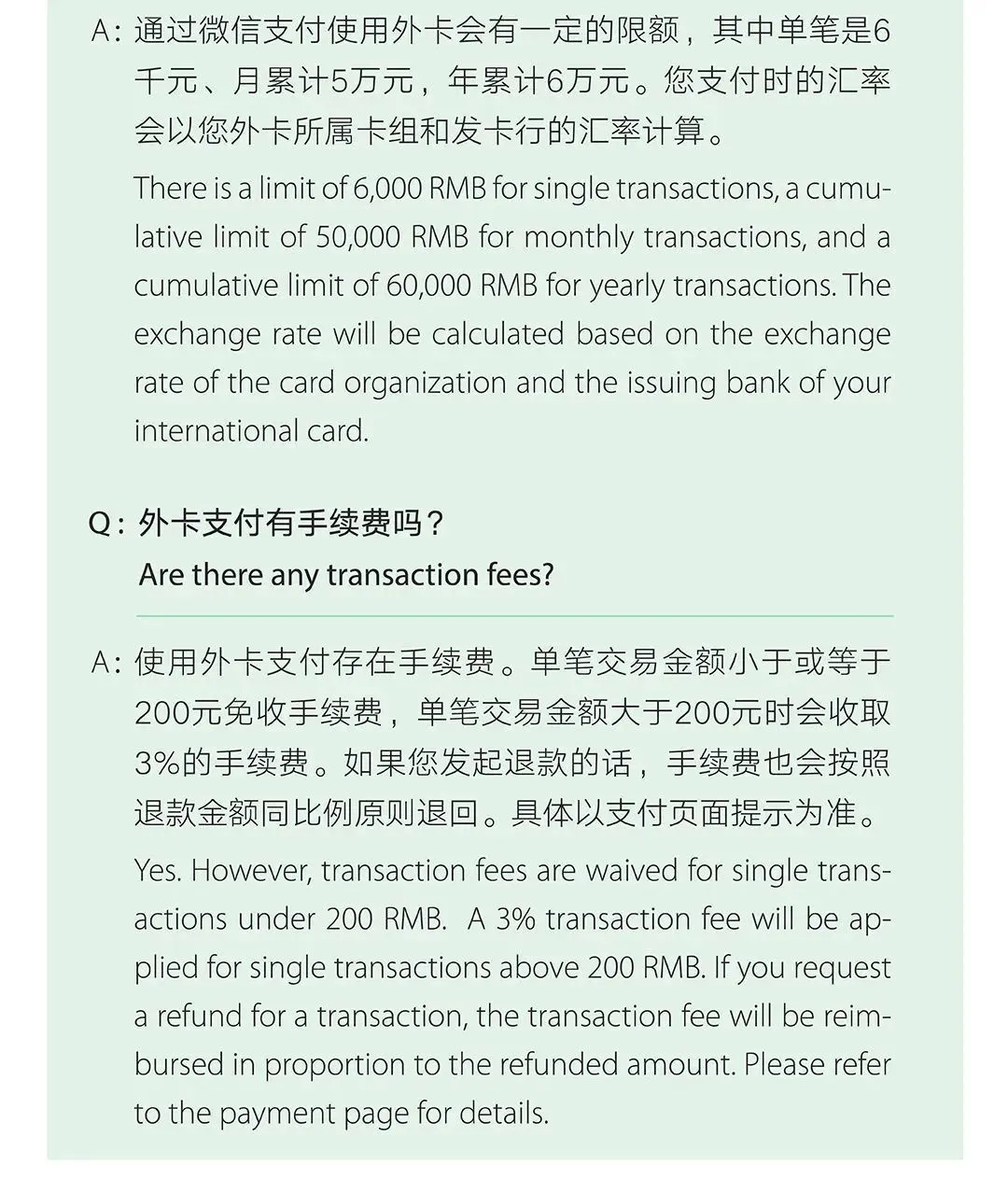

Weixin Pay (WeChat Pay)

Weixin Pay is another widely accepted mobile payment option.

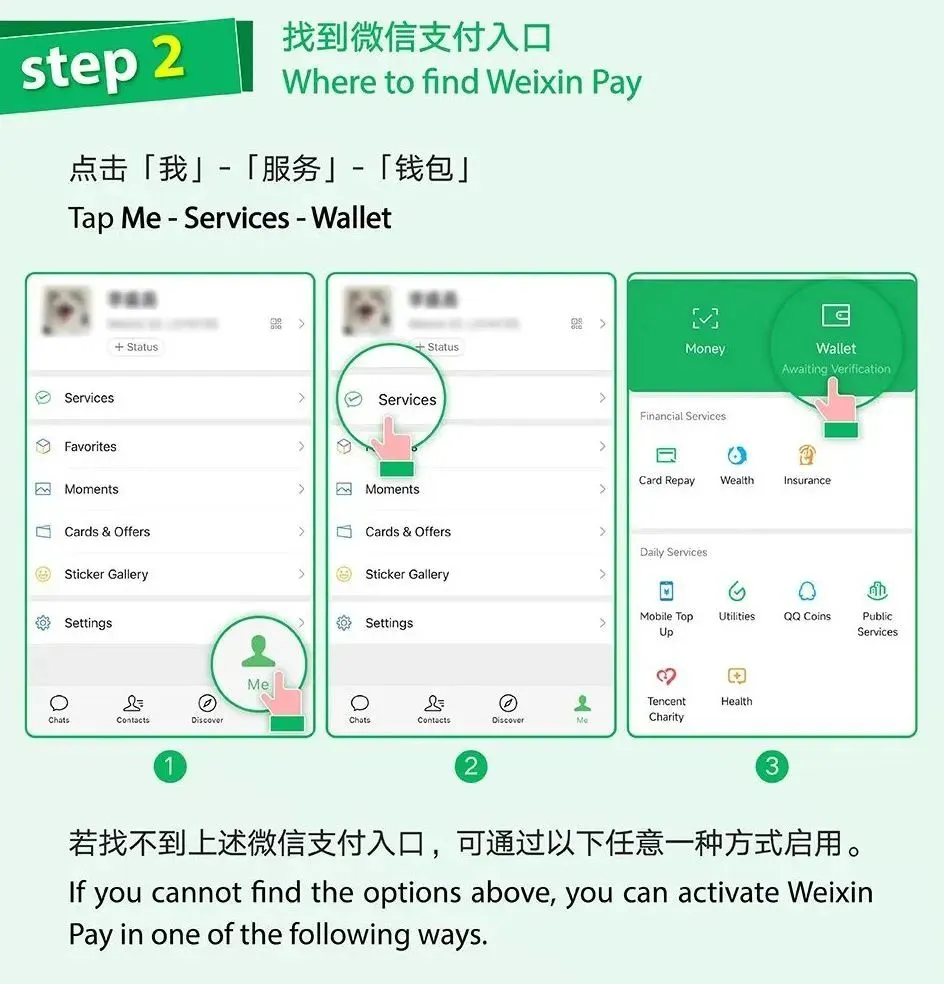

How to Use Weixin Pay

1. Download: Download the WeChat app in the app store.

2. Register/Sign In: Open the WeChat app and register with your phone number or just sign in if you have already registered.

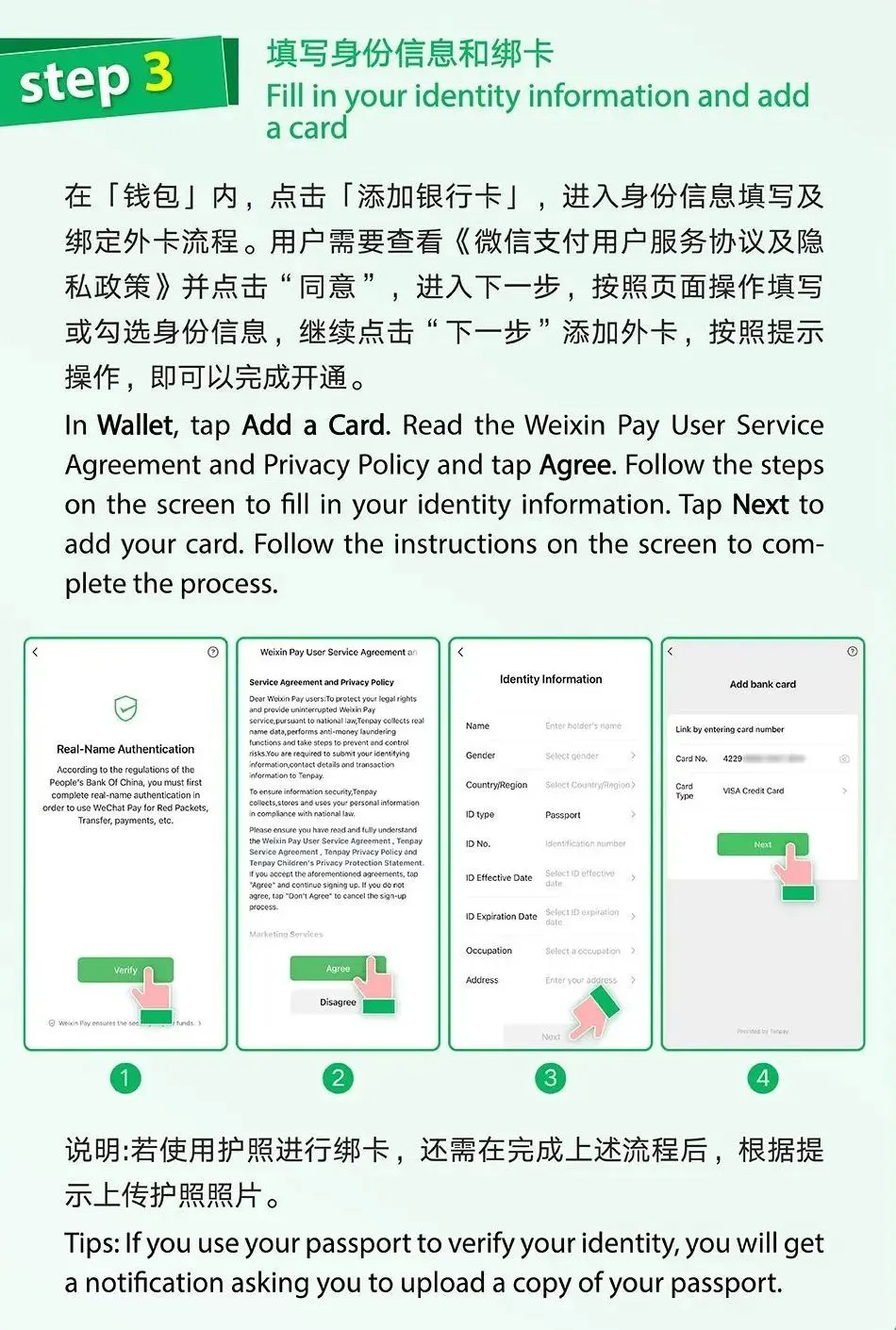

3. Add Bank Cards: Visa, Mastercard, American Express, JCB, Diners Club, and Discover cards can all be added to Weixin Pay.

4. Pay: You can pay by scanning a merchant’s QR code (Method 1: Tap the “+” sign at the upper right corner and then the “Scan” icon, and scan the merchant’s QR code) or by presenting your QR code for the merchant to scan (Method 2: Tap the “+” sign at the upper right corner and then the “Money” icon, and present your QR code to the merchant).

• English Service Hotline: For support, contact the Weixin Pay English Service Hotline at +86-571-95017.

UnionPay App

UnionPay offers its own mobile payment application.

How to Use UnionPay App

1. Download: Download the UnionPay app from your app store or its official website.

2. Register/Sign In: Register with your phone number and sign in.

3. Add Bank Cards: The app currently supports overseas UnionPay cards issued in places such as Hong Kong SAR and Macao SAR.

4. Pay: You can pay by scanning a merchant’s QR code (Method 1) or by having a merchant scan yours (Method 2).

• Tour Card: UnionPay also offers a prepaid “Tour Card” that can be applied for and topped up in the UnionPay app for everyday purchases, online or offline.

• English Service Hotline: UnionPay provides an English Service Hotline at 95516 (for users with Chinese-mainland mobile phone numbers) or +86-21-95516/+86-21-20556900 (for users with non-Chinese mainland mobile phone numbers).

It’s worth noting that some international e-wallets are also accepted by merchants in China, allowing you to pay directly without downloading other apps.

Bank Cards

Familiarity and Widespread Acceptance

Bank cards issued in your home country/region can be accepted in China if the logos of your bank cards, such as UnionPay, Visa, Mastercard, American Express, JCB, Diners Club, and Discover, are displayed at the checkout counter. A UnionPay card, in particular, is accepted by all merchant POS terminals in China’s mainland. The Beijing Subway now supports payment with overseas bank cards.

Cash

A Traditional Option Still Available

While digital payments are dominant, you can still use cash in China.

• Withdrawals: You can withdraw RMB cash from ATMs that accept international bank cards at ports of entry or in downtown areas.

• Currency Exchange: Exchange other currencies for RMB through authorized exchange service providers, self-service exchange machines, some hotels, bank branches, and currency exchange kiosks. Look for an “exchange” sign for easy identification.

• Conversion Back: You can also convert your remaining RMB cash back to your own currency or other major currencies in downtown areas or at the port of exit with the help of currency exchange service providers.

Bank Account

For Longer Stays

For those planning an extended stay, opening a bank account might be beneficial.

• How to Open: You can open a bank account with your passport or other valid IDs at major bank outlets such as Industrial and Commercial Bank of China (ICBC), Agricultural Bank of China (ABC), Bank of China (BOC), China Construction Bank (CCB), and Bank of Communications (BOCOM).

• Services: A bank account allows for a variety of financial services, including deposit and withdrawal of RMB and foreign currencies, foreign currency purchase and sale, domestic transfers, cross-border remittances, and making payments.

E-CNY: China’s Digital Currency

You can also make payments with E-CNY, China’s digital currency, if interested.

How to Use E-CNY

Download the “e-CNY” app and scan the QR code to download it.

• Pilot Areas: E-CNY app registration is currently available to users in specific pilot areas including Beijing, Shanghai, Guangzhou, and many other cities.

• Customer Service: A 24-hour E-CNY customer service hotline is available at +86-10-956196.